Mortgage lenders and house builders are more concerned with rebuilding their balance sheets than in building the number of new homes the UK needs.

Some facts for you;

- UBS, the ‘financial services’ company, have been fined $1.5 bn for rigging markets.

- HSBC have been fined $1.9 bn for laundering money from drug cartels.

- The new Governor of the Bank of England will be paid an additional £250,000 per year to cover his housing costs.

- Over the next 20 years there will be 232,000 new households formed each year in the UK

- In the middle of 2012 mortgage lenders lend half as much money in mortgages as they did in the same time in 2007

- Private house builders built under 100,000 new houses in 2011

- UK companies currently have cash reserves of over £700 billion

What does this all add up to?

Evidently there are deep problems in the UK banking industry and the UK house building industry.

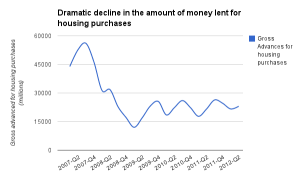

Mortgage lenders are less keen to lend. Here is a graph of the amount of money lent for mortgages in the UK over the past 5 years;

Not only has there been a dramatic decline in the amount that is being lent for mortgages, there appears to be some stablization. We seem to be in a new equilibrium, a new normal. There is just a lot less money being lent out to people to buy houses.

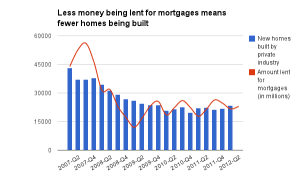

This is having the expect impact on house building. Here is a chart of the number of houses that were build by private house builders (i.e. by private businesses not by housing associations or councils);

Again, we see a dramatic reduction in the numbers, and an apparent stablization of the numbers. This appears to be the new normal. Less money being lent out, fewer homes being built. Here is a chart showing the two trends together;

There is little prospect of any of this improving. As Robert Peston, the BBC’s Business Editor, recently wrote;

“Banks are trying to shrink the loans and investments on their balance sheets, relative to the capital they hold as protection against losses.”

A similar movement is taking place in the house building industry. Taylor Wimpey, one of the largest house builders in the UK, said in their annual report;

“we continue to prioritise margin performance ahead of volume growth”

This is understandable. As a trade publication put it,

It has been a long road back, but the UK house-building sector is finally starting to make money again. The top 20 house builders have returned a healthy aggregate profit in 2012 of £538.7m – four years ago, they lost almost £4bn. In 2008, as the housing bubble burst spectacularly, the house-building sector imploded with such force that the survival of many of its biggest names seemed unlikely.

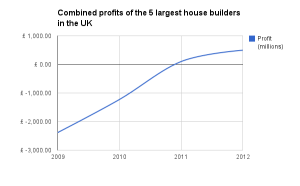

This chart shows this return from the brink (data from here). It shows the combined profits of the 5 largest house builders in the UK and quite how badly they were doing a few years ago.

The sector is now making profits, although modest ones. However, they are doing so through a model that focuses on getting large profit margins through building (relatively) small numbers of houses.

For the country, this is a terrible equilibrium to have hit upon. We are not building enough houses to keep up with the number of new households being formed. We are not building anywhere near enough houses. The longer we build too few houses the harder it will be to build enough houses for these households.

The irony is that if policy makers could come up with a clever investment vehicle to fund the building of these new homes it would be exactly the kind of thing that non-financial corporations would be interest in investing in, and this in turn would be exactly the kind of thing that would stimulate growth in the economy.

Courtesy of Tom Neumark via Dream Housing

Comments

No responses to “Mortgage advice”