The bedroom tax is in its 11th week and social housing is already in chaos. It doesn’t augur well for social housing in its entirety and that is not hyperbole or exaggeration.

The scale of the non-payment and part-payments of the tenant rent shortfall the bedroom tax creates is giving shockwaves in the boardroom of every social landlord. Nobody predicted this level of arrears increases and it has surprised everyone. While the early figures are just that, early, they are huge and if they continue then doubtless many social landlords will get into deep financial trouble and some WILL fold or be taken over by the larger groups. Yet even they are not immune and while I doubt the huge 54,000 home strong Riverside group will go bust their early figures of 50% zero payment and 25% part payment are alarming. As are the figures for YHN in Newcastle or HHT in Halton both much smaller HAs and there are plenty of other examples too.

While it is easy to be a doom scaremongerer and take these early figures as evidence of impending crisis, there is genuine reason for alarm. The bedroom tax is less financially damaging to landlords than the benefit cap and direct payment of HB to tenants. Worse ‘reform’ is to come in other words. These early bedroom tax figures are in the context of the added pressures these later reforms will bring and I doubt other contextual factors such as welfare benefit increase below inflation while household expenditure such as gas, food, electricity all are rising at higher than inflation have yet to fully kicked in.

Landlords response has, not surprisingly but stupidly in my view, been to ramp up arrears collection activities. It is not stupid that landlords are doing this just the way they are going about it and this is one area where social landlords need to stop and think. In fact social landlords really do need to think clearly and fully for the first time – I would say have a rethink ordinarily yet I don’t believe they thought about and considered the welfare reform impacts at all.

One example of this is the benefit cap which I repeatedly criticised social landlords and the entire social housing sector all last year for ignoring and appearing blasé about. The DWP impact assessment from June 2012 says 46% of those affected live in social housing yet the strong impression social landlords gave and continue to give is that they believe this is ONLY a problem for private landlords and in high rent areas such as London. That is an incredibly naive view and a very neglectful one.

The average cut for the 41,000 social tenants who have been sent letters by the DWP is £93 per week. If the bedroom tax tenant household with its average £14 per week cut in HB cannot afford to make up a £14pw shortfall they don’t have a hope in hell’s chance of making up a £93 per week shortfall. In other words the benefit cap social tenant household is a guaranteed certainty to be evicted for arrears and very quickly and highly likely to be before the bedroom tax arrears evictions.

Social landlords whether HA, ALMO or Council cannot bear such high arrears losses and eviction of these benefit cap households is inevitable. Yet one of the less considered impacts of this is how this will impact on the landlord to local Council relationship which needs to be good and strong for obvious reasons.

I have criticised the social landlord to Council relationship as being complicit in the bedroom tax decision making. Councils simply took the word of social landlords on what a bedroom is and how many bedrooms each property has. It was in the mutual financial interests of both landlords and councils to do this and that is undeniable whether you agree or not with my complicity argument. Yet the benefit cap relationship is very different and while arrears evictions are in social landlords financial interests they add hugely to council homelessness costs and especially since Steve Webb is on record in parliament as saying families evicted for arrears caused by the welfare reforms that are out of their control – which the benefit cap reductions are – mean councils should find such families UNINTENTIONALLY homeless and therefore councils have a full homeless duty with its large associated costs.

Local Councils will – out of necessity – be pressurising social landlords not to evict such cases while recognising that landlords have little choice but to evict for arrears. The landlord council relationship sours significantly because of this which does not bode well for social landlords then asking Councils to support development bids or in planning permission terms etc., which it has to do.

I also predict strongly that tenants will start targeting social landlords more and burdening them with higher costs as the ‘reforms’ really start to bite. Why did my landlord choose to give property information to the Council when it did not have to provide anything at all? As tenants become increasingly aware of bedroom size arguments ala 1985 Housing Act, or HSE 1998 guidance over gas appliances and other potential appeal challenges then tenant will step up ‘pressure’ on social landlords.

How long before tenants who maintain they have 2 bedrooms and a boxroom and not 3 bedrooms as their landlord says, begin to write to landlords to say they believe their rent is too high and should be reduced. If their “3 bed” rent is £90 per week and a 2 bed rent is £80 per week will tenants write and offer to only pay £85 per week of the £90 per week the social landlord wants? In fact many Councils are telling bedroom tax tenants to take up the number of bedrooms their property has with their landlords and not them. So tenants would only be doing what their Councils tell them to do!

How long before tenants mitigate and nullify the social landlords’ response to the bedroom tax arrears collections? Every landlords policy says something to the effect that the landlord will ramp up evictions where the tenant “refuses to engage” with them or very similar wording. Yet tenants are very angry at letter after letter, phone calls, text messages and unannounced visit from ‘income officers who then errantly and unlawfully claim to have a legal right of entry and then again claim to have a legal right to do a financial statement of means on the tenant finances. All any tenant has to do to show they are engaging and not burying their heads in the sand is to write to the landlord stating all correspondence between the parties can only happen by letter and not by calls, texts or visits as such landlord recovery actions may end up in court?

The tenant would also be wise to tell the landlords they have appealed the bedroom tax decision and have applied for a DHP and any shortfall in rent payments from them is because they can’t afford to pay and not because they are a ‘wont payer.’

These are obvious and simple matters that tenants will start to do if they haven’t already and they nullify landlords intentions to get ‘financial statements’ or generally to scare tenants into paying and also many of these matters will increase landlords costs as they will have to respond in writing.

Also when I drafted the template letter with 6 questions for tenants to ask of their Councils, most Councils refused to answer two key questions – what information did Councils request of landlords and what did the landlord respond with. Tenants need such information for their appeals and they will be asking for that necessary and reasonable information now from landlords. Again this costs landlords more and more and if landlords don’t supply then tenants will merely see their landlord blocking their legitimate appeal challenges – not good for the landlord tenant relationship at all…and especially not before tenants take control of rent payments by having HB directly paid to them from October as another of the welfare reforms this coalition has imposed.

Yet that is the real rub – the coalition imposed these pernicious welfare reforms on tenant, landlord and council and now all three are infighting with one another while the coalition sits back and smirks at this!

The tenant can’t pressurise the coalition directly yet needs to pressurise it via landlord and local council and the judiciary by appealing in huge numbers. The tenant, the landlord, the councils and the judiciary all despise the bedroom tax and the rest of the coalition welfare reforms yet instead of all uniting against reforms they end up infighting!!

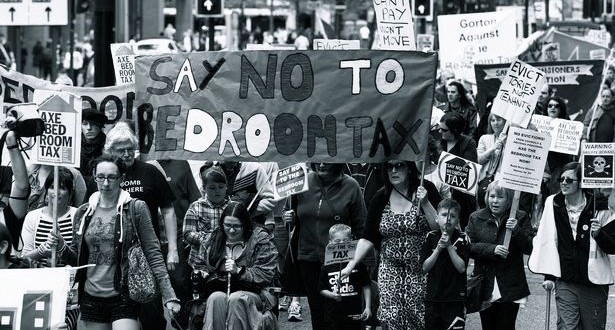

That infighting can only increase unless radical change by landlords and councils take place and they stand behind the surprisingly large and increasingly powerful tenant bloc which has emerged. If it doesn’t the tenant will blame landlords and local councils who also have been shafted by these ‘reforms’ just as the tenant has. The coalition nullified the Lords, the Commons, Local Government and Landlords with the bedroom tax and didn’t believe that tenants had any power or they were not a threat to them. Yet with reliably over 40,000 members the anti bedroom tax groups have twice as many members as the CIH for example and the 40,000 figure is a conservative one and growing and will grow even further once the benefit cap hits in just over 4 weeks time and when monthly and direct payments kick in 10 weeks later. By that time the full impacts of paying council tax for the first time, below inflation benefits rises and much higher than inflation household expenditure in food and utilities will have kicked in too.

The infighting can go on for tenants yet it can’t for landlord and council. That is a reality that should send even more chills into social landlord boardrooms and councils.

Social housing as a model has been targeted with the welfare ‘reforms’ and especially as the bedroom tax and benefit cap only cut Housing Benefit not welfare benefit levels. Yet social landlords’ responses and considerations of its impacts have been unfortunately inept. While the NHF as one umbrella group has done some good work the CIH the professional body has been woeful and that is giving it too much praise.

Yesterday I posted a reworking of an earlier blog from January which said social landlords should reclassify as this will mitigate and nullify the bedroom tax within two years and not take 5 or 7 or even longer for the ridiculous downsizing suggestion to take place. It is in social landlord’s best financial interests to do so. It needed restating not because of Professor Steve Wilcox stating the same argument in May and lending his gravitas to the argument, but primarily because the bedroom tax arrears had been so unexpectedly high and makes it a necessity.

Take the claimed three bed property at £90 per week that could (and should be described) as a 2 bed plus large (50 -70sq/ft) boxroom. This wouldn’t see a reduction to a 2 bed only rent of say £80 per week and a £10 pw reduction – it could and should be reclassified as an ‘enhanced’ 2 bed rent of say £87 per week. The nominal £3 per week loss takes away the average £14 per week bedroom tax and the £3 can easily be made up through rent increases over the next two years. The 2 bed and small (ie under 50 sq/ft) boxroom is still more than a mere 2 bed alone property and so reclassified and rented at say £84 per week. Again this nullifies a £14 per week bedroom tax risk and again the £6 per week nominal loss can easily be recouped over two years.

Yet social landlords are loathe to do this as they errantly believe they cannot do it o that the HB regulations say it can’t be done or as YHN errantly said there are “strict government rules” which prevent this! Utter nonsense and if anyone cares to tell me which government “rules” these are then let me know as the don’t exist except in social landlords minds or in their PR spin they issue as news releases.

Bristol and Nottingham have already (albeit post April 2013) decide that anything under 50 square feet is a bedroom. Why don’t all landlords follow suit and do so as I explain above – the bedroom tax financial threat and tenant arrears threat go away and much more quickly than the current unfortunately conservative and naive response of the social landlords.

Why oh why landlords and councils see a need to infight with the similarly shafted tenant is beyond me and beyond any sensible comprehension. Social landlords should sit around a table with tenants and anti bedroom tax (ABT) groups and listen and learn – and yes it is a two-way street.

About six weeks ago one such ABT group rather cheekily rang me late one Tuesday afternoon asking if I could make a Thursday morning meeting with KHT they had arranged. I could re-arrange my schedule but made it dependent on KHT saying this was acceptable – I had criticised them specifically over the publicity they sought (brownie points if you will) for reclassifying 4% of their stock which were difficult to lets. KHT had no problems with me being there which was good and professional.

The meeting saw me and 4 ABT members and from KHT there was Bob Taylor the CEO and the Director of Customer Service , Director of Housing and a minute take – a turnout of the key executive management team and impressive. The meeting was scheduled for an hour and was an extremely open and honest meeting that lasted 2.5 hours – more impressive and clear evidence of how serious KHT viewed the meeting.

Both ‘sides’ learnt a lot! The ABT group discovered that KHT like all landlords had been lobbying government more than expected. They also realised that despite their preconceptions social landlords do have limited influence and got most of the fact that social landlords can be hamstrung in terms of challenge given the restrictions charitable status has for anything remotely seen as political activities.

KHT, while having communicated with tenant groups and their housing officers individually with individual tenants – the same as all HAs – heard some incredibly moving tales of what the bedroom tax meant. Many of the impacts of it became much clearer as did the impacts it would have for tenants and for KHT as landlord. Many issues were talked in depth rather than in superficial terms which most landlords do as they don’t have such meetings. For instance KHT stated the often heard position that they are seeking to sort out the cant payers from the wont payers – a typical statement all landlords have said. Yet landlords don’t elaborate on that incredibly difficult even in theory statement whereas the meeting discussed it in some detail which was mutually beneficial.

I won’t go into any more detail than that except to say the meeting resulted in the ABT group having a lot more understanding of the landlord’s lot and the landlord having a lot more understanding of the tenant’s lot. A few days later KHT issued what was then the most damning news release to date about the bedroom tax.

I receive about 60 unsolicited emails from tenants about the bedroom tax right across the country every day. Mostly they alert me to ‘bad’ social landlord practise or bad council practise and if I get enough of similar stories which I can verify I do tend to publish such stories through the blog. Landlords doorstepping techniques and ramped up arrears collection to Councils stating tenants have no right of appeal or other ‘dirty tricks’ etc. I have heard no such stories from Knowsley where KHT is by far the largest landlord and Knowsley also has the largest percentage of bedroom tax affected households in the North West. Anyone see a link there?

Landlord and councils fighting with tenants has to stop and both, but especially social landlords need to totally rethink their welfare reform strategies. They need to work WITH tenants and harness the power tenants have and not work AGAINST tenants. Councils need to do the same.

As I said above and now finish with tenants can afford to continue their fight against landlords and councils. All the tenant can do is fight to persuade landlord and councils to stand behind them and have nothing to lose by doing so. If that is the only way they can get landlord and council ‘onside’ – and all have the same ultimate cause then they will continue to do so and with ever greater pressure. Yet landlords and councils can’t afford to carry on fighting tenants and especially landlords.

Courtesy of Joe Halewood at SPeye

Comments

No responses to “Bedroom Tax arrears – huge and why social landlords need a major rethink”